Understanding the ACA landscape in 2025

As the Affordable Care Act (ACA) turns 15 in 2025, states are at a critical juncture related to health reform—one marked by increasing enrollment, expiring subsidies, higher inflation, and rising demand for localized innovation.

Executive summary

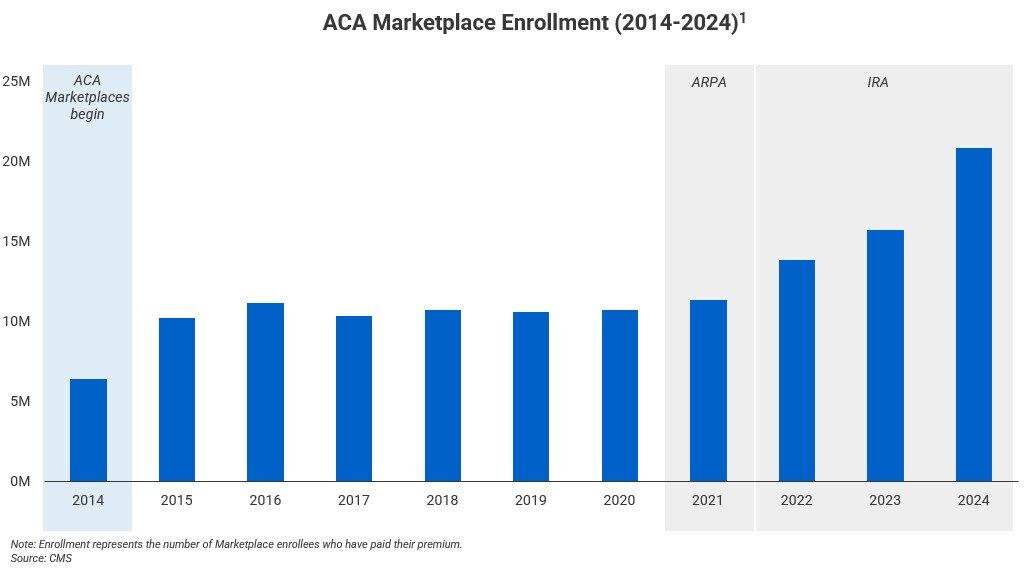

Over the past five years, enhanced federal subsidies from 2021’s American Rescue Plan Act (ARPA) and 2022’s Inflation Reduction Act (IRA) have fueled record ACA Marketplace enrollment (see figure 1). With the expiration of these subsidies looming in 2025, however, states must prepare to fill the gap. States and consumers await Capitol Hill’s decision on the future of these subsidies, and state lawmakers are thinking about how to address the challenge of sustaining insurance coverage and premium costs for their constituents. Some states have adopted State-Based Marketplaces (SBMs) as a way to provide local control, operational flexibility, and find cost advantages over the Federally Facilitated Marketplace (FFM). With several successful transitions already complete—and more states actively considering or pursuing their own exchange—state leaders must evaluate how evolving federal policy may shape local coverage strategies in an uncertain political environment.

Introduction

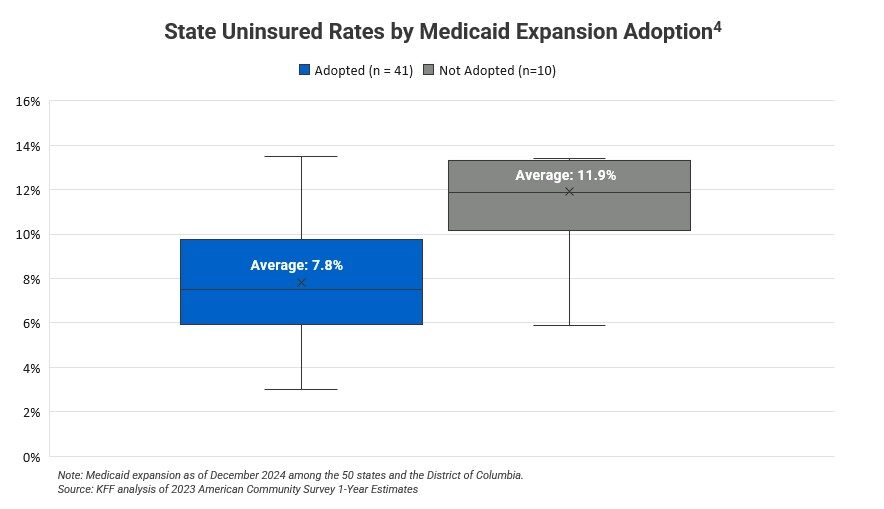

The Affordable Care Act (ACA) fundamentally reshaped how millions of Americans access health insurance, establishing new marketplaces, expanding Medicaid in many states, and introducing government-provided subsidies, making coverage more affordable. The ACA’s rollout coincided with substantial changes in the health insurance market, including standardized benefit requirements and new consumer protections. Since its passage in 2010,2,3 the law has weathered significant political and legal challenges, from early disputes over the constitutionality of the individual mandate to ongoing debates over the Act’s scope and funding. In spite of this, the ACA has proved successful in many regards. As one indicator of its success, between 2010 and 2023, the uninsured rate for adults under 65 fell from 17.8% to 9.5%,4 representing one of the largest coverage gains in U.S. history. Gaps remain, however; the 2025 uninsured rate is projected to be 7.6%,5 with the majority of uninsured individuals being low-income, people of color, and noncitizens.

A convergence of new federal policies in 2025 will almost certainly redefine the future of ACA-built marketplaces and healthcare affordability. Provisions under the One Big Beautiful Bill Act (OBBBA), signed into law on July 4, 2025, are expected to significantly increase coverage barriers by introducing Medicaid work requirements, tightening subsidy eligibility restrictions, and increasing cost-sharing among Marketplace enrollees. At the same time, funding cuts to the Centers for Medicare & Medicaid Services (CMS) federal navigator program may further limit individual access within the FFM. Upon implementation of the OBBBA and the expiration of federal subsidies at the end of 2025, the Congressional Budget Office estimates a nationwide increase in the uninsured of 16 million by 2034.6 Within the context of this federal uncertainty, states can play a role in supporting consumers through supplemental subsidies, streamlined eligibility and renewal systems, targeted outreach to at-risk populations, and robust insurer engagement.

Analysis

The Health Insurance Environment Before the ACA (Pre-2010)

Before the passage of the ACA, the U.S. health insurance landscape was marked by declining coverage rates and growing affordability challenges.7 Rising premiums were often paired with higher cost-sharing requirements, leaving many Americans—particularly those with lower incomes—unable to access or maintain coverage. Individuals with pre-existing conditions or higher expected healthcare needs faced even greater barriers, as insurers frequently charged significantly higher premiums or limited benefits to manage risk.8 The low-coverage environment sparked political debates and prompted meaningful reform.

Implementation of the ACA (2010-2024)

Enacted on March 23, 2010, the ACA set out to address gaps in U.S. health coverage and affordability by establishing insurance marketplaces, establishing minimum coverage standards, providing premium subsidies and tax credits, and expanding Medicaid eligibility. A hallmark of ACA, Marketplaces are digital platforms where consumers shop for qualified health plans and access income-based help such as premium tax credits and cost-sharing reductions. Under the ACA, every state must either use the Federally Facilitated Marketplace (FFM), called HealthCare.gov, or create an enrollment website operated at the state level, known as a State-Based Marketplace (SBM).9 In addition, the ACA established a federal floor, or minimum set of rules for insurers in individual and small-group markets. These require plans to cover a set of essential health benefits—such as preventive care, maternity services, hospitalization, and prescription drugs—and to meet specified actuarial values that determine how much of the cost is covered under “metal tier” plan levels (Bronze, Silver, Gold, and Platinum), which indicate how costs are shared between the insurer and the consumer.8 Marketplaces created a space to determine tax credit eligibility and offered subsidies to lower premiums for disadvantaged individuals. Finally, under the ACA, eligibility for Medicaid coverage expanded to people with incomes up to 138% of the federal poverty level.9

Since the ACA’s implementation, the U.S. health insurance market has changed significantly. Nationwide, the uninsured rate for residents under age 65 fell at a compounded annual reduction rate of 4.72% from 2010 to 2023.4 More recently, health insurance affordability has improved through enhanced subsidies provided under the 2021 Inflation Reduction Act (IRA), with average net premiums paid by the consumer falling by 31% from 2021–2025,10 driving Marketplace enrollment growth nationwide. Beyond coverage gains, the ACA established additional consumer protections such as guaranteed issue/community ratings (insurers cannot deny coverage or charge more based on health status), no annual or lifetime limits, free preventive services such as annual check-ups and screenings, and dependent coverage for young adults up to age 26.

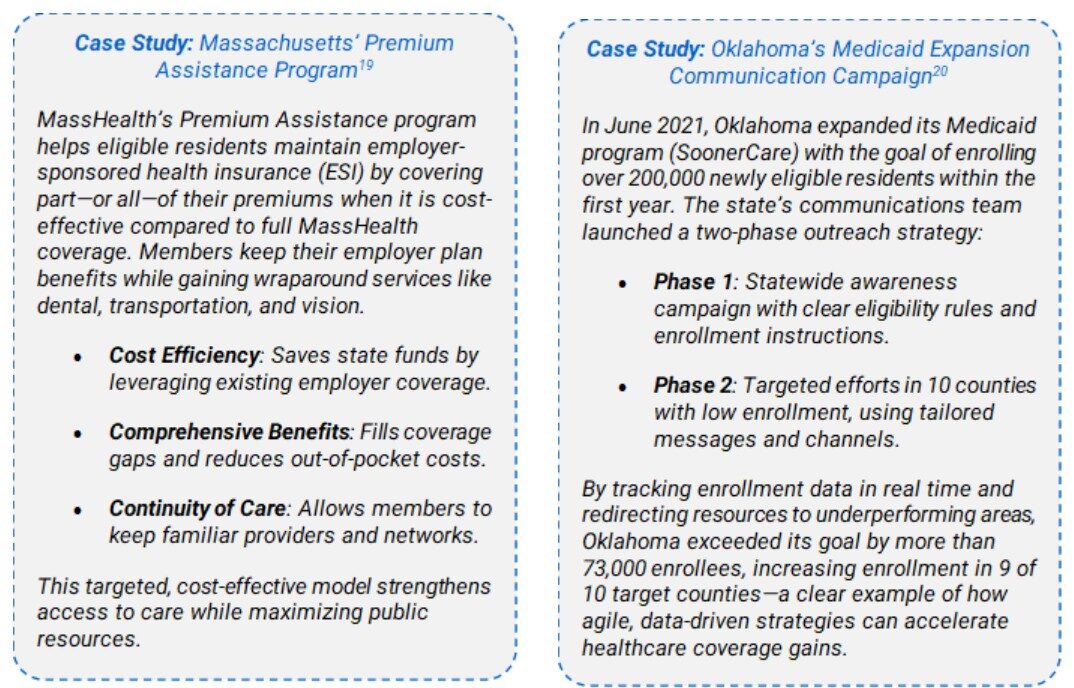

Health insurance availability and affordability has not been equal throughout the United States. States that have expanded Medicaid have made the largest strides since 2010, with uninsured rates on average four percentage points lower than their non-expansion state counterparts (see Figure 2) in 2023.4,11 Moreover, SBMs have sustained enrollment growth through innovative outreach and marketing strategies as a result of longer open enrollment periods, layered state-funded subsidies, and automatic re-enrollment initiatives.

Federal Policy Dynamics in 2025

Signed in July 2025, the One Big Beautiful Bill Act makes several changes that impact the ACA’s coverage architecture. Key provisions of OBBBA add work requirements and increase the documentation required to establish Medicaid eligibility. This is true for individuals applying for new coverage or seeking to renew coverage.12 The law also narrows premium tax credit eligibility and restores full repayment of excess premium tax credits at year-end, increasing the risk of unexpected bills, especially for lower-income people who more often experience unpredictable incomes.13 In addition, the OBBBA limits open enrollment periods and fails to extend enhanced premium tax credits, which end at the end of 2025. Democratic Senator Jeanne Shaeen (D-NH) claims that expiring premium tax credits will result in a more than 75% increase in enrollee premium payments14 and the Congressional Budget Office estimates 4.2 million people will lose Marketplace coverage by 2034.6 Republican Congressman Jason Smith (R-MO) opposes an extension of the enhanced credit, stating that it provides an untargeted benefit for those at more than 400% of the federal poverty line, also noting that a CBO analysis also shows that the Act’s anti-fraud provisions lower ACA premiums by 0.6%.14

When the COVID-19 continuous coverage requirement ended in April 2023, states resumed regular Medicaid eligibility redeterminations (a process known as “unwinding”). Since then, disenrollments—the active unenrollment of individuals who are no longer eligible or who do not complete the renewal process—have risen nationwide, often for procedural reasons rather than actual changes in eligibility.15 States that maximized “ex parte” (automatic) renewals,16 applied targeted flexibilities, and strengthened outreach programs experienced fewer disenrollments.

In February 2025, CMS reduced federal Navigator funding for HealthCare.gov states (i.e., those states using the FFM) to $10 million annually,17 citing cost-effectiveness goals and noting that FFM user fee savings could lower premiums modestly. While the cut applies to the FFM, states running SBMs control their own outreach budgets and strategies—an important lever as federal resources shrink. Large reductions in assistance programs can impede enrollment for harder-to-reach populations, underscoring the value of state-directed outreach and navigation capacity.

Directors of SBMs have warned that the combination of tighter eligibility verification rules, shorter enrollment timelines, and changes to subsidy policies could destabilize risk pools and increase consumer costs. In a June 2, 2025 letter to Senate leaders, SBM executives from 18 states urged Congress to maintain enhanced premium tax credits and reject provisions that prohibit automatic renewals and require duplicative documentation, arguing these steps would push healthier consumers out of Marketplaces and drive up premiums for those who remain. In addition, these leaders claim that the reconciliation bill ends long-standing state autonomy to steward local health insurance markets and meet unique state needs.18

What MGT thinks?

As federal coverage policies grow more volatile, states would do well to consider how they can most effectively transition from reactive administrators to proactive stewards of healthcare insurance access. The expiration of IRA subsidies and the implementation of OBBBA represent risks to affordability, enrollment stability, and continuity of care—particularly for Medicaid-eligible populations, rural communities, and working-class families. State-based marketplaces (SBMs) give states the control and agility to craft solutions that meet their unique needs by unlocking innovation, boosting resilience, and protecting coverage when federal policies shift.

However, the move to an SBM is a significant undertaking. Without the right infrastructure, funding, and operational capacity, states risk higher costs and service disruptions. It’s critical that states assess their readiness, map the path forward, and design exchanges built for long-term success. With the right plan and partner, states can turn SBMs into powerful engines for affordability, stability, and better care.

We recommend that state leaders:

- Conduct readiness audits to assess SBM transition feasibility, with a focus on cost neutrality and Medicaid alignment.

- Explore partial or phased transition pathways, beginning with plan management or consumer outreach.

- Develop localized strategies such as state-level subsidies or navigator infrastructure to protect residents if IRA subsidies expire and OBBBA policies remain in force.

- Build governance structures that allow for continuous platform iteration and responsive policymaking.

Call to action

With so-called subsidy cliffs approaching, Medicaid disenrollments rising, and outreach funding shrinking, states cannot afford to adopt a one-size-fits-all approach. MGT brings 50 years of experience helping governments navigate uncertainty through strategic execution and data-driven insights, earning the trust of leaders committed to delivering meaningful results for their communities. Our expertise spans policy management, market assessments, transition planning, and full-scale implementation support to SBMs, making us a trusted partner for states seeking stability and strategic guidance in the midst of federal uncertainty.

We offer tailored briefings and advisory services to help you answer critical questions, including:

- What will the expiration of enhanced subsidies mean for your residents?

- How will premiums, cost-sharing, and enrollment shift post-IRA?

- Where is your state most vulnerable during Medicaid unwinding—and how can you mitigate it?

- What is the strategic, financial, and operational case for transitioning to (or optimizing) a State-Based Exchange?

- How can targeted marketing, outreach, and broker engagement preserve enrollment momentum?

Contact our team for a tailored briefing on strategies to navigate recent federal actions and strengthen healthcare access across your state’s unique landscape.

References

2 https://www.senate.gov/legislative/LIS/roll_call_votes/vote1111/vote_111_1_00396.htm#position

3 https://clerk.house.gov/Votes/2010165

4 https://www.kff.org/uninsured/issue-brief/key-facts-about-the-uninsured-population/

5 https://www.cms.gov/files/document/certification-rates-uninsured-2025-final-rule.pdf

6 https://www.cbo.gov/system/files/2025-06/Wyden-Pallone-Neal_Letter_6-4-25.pdf

7 https://www.cbpp.org/research/employer-based-health-coverage-declined-sharply-over-past-decade

10 https://www.cms.gov/files/document/health-insurance-exchanges-2025-open-enrollment-report.pdf

14 https://tax.thomsonreuters.com/news/concerns-grow-as-premium-tax-credit-sunset-looms/

16 https://www.medicaid.gov/federal-policy-guidance/downloads/cibe1411142024.pdf

17 https://www.cms.gov/newsroom/press-releases/cms-announcement-federal-navigator-program-funding